Introduction

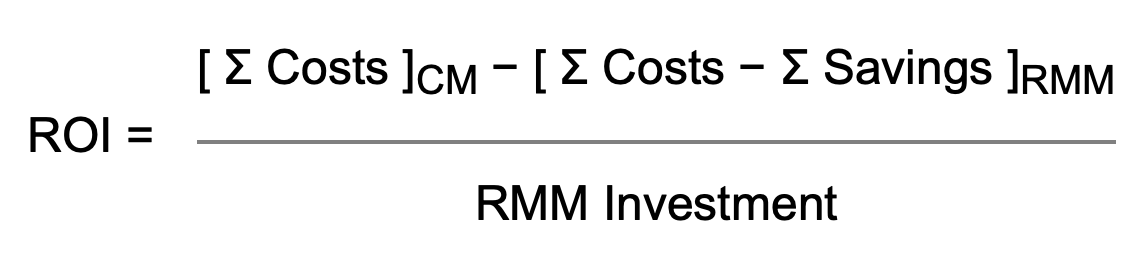

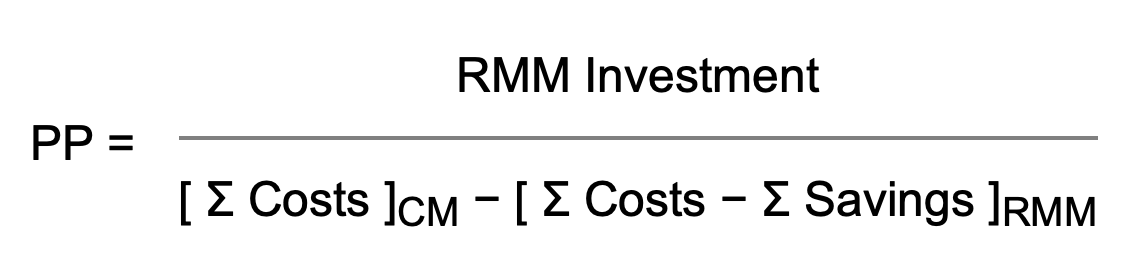

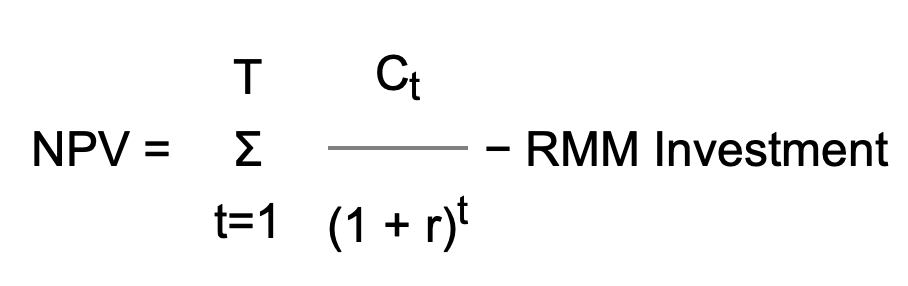

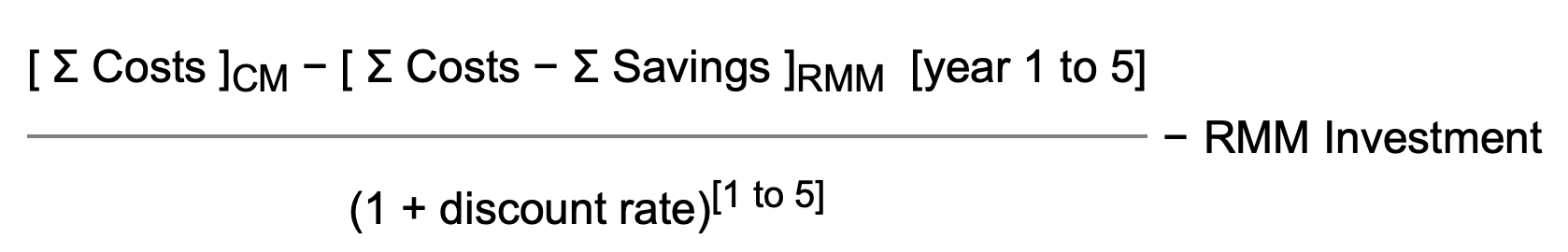

When proposing a change in the manufacturing environment, today's economic climate forces us to debate between scientific opportunity and validation costs, improving product quality versus return on investment (ROI), and moving toward a model of continuous improvement without impacting the bottom line. When it comes to the implementation of rapid microbiological methods (RMMs), pharmaceutical microbiologists and QC managers have been challenged by their finance departments and manufacturing site heads over the potential costs associated with the evaluation, qualification and installation of these novel technology platforms. If the industry is going to move into the 21st Century with regard to the implementation of RMMs in Process Analytical Technology (PAT) and Quality by Design (QbD)-driven surroundings, then we must be prepared to use appropriate financial models to economically justify the time and expense in qualifying and utilizing these new approaches. A number of case studies on the development of RMM financial analyses have recently been published, and a list of these papers is provided on our References page.